Eligible First Home Buyers (FHB) of properties up to $1.5 million can now choose to pay a smaller annual property tax instead of an upfront transfer duty (previously known as stamp duty). The property tax is only available to first home buyers who choose it and will be payable for as long as they own the property.

Existing FHB conditions still apply including Stamp duty exemptions for properties up to $650,000 (no stamp duty), and stamp duty concessions will still apply for properties up to $800,000. You must move into the property within 12 months of purchase and live in it continuously for at least 6 months.

Eligibility and Requirements (NSW)

You must be an individual (not a company or trust)

You must be over 18 years old

You, or at least one person you’re buying with, must be an Australian citizen or permanent resident

You or your spouse must not have previously owned or co-owned residential property in Australia, nor received a First Home Buyer Grant or duty concessions

The property that you are buying, new or existing home in NSW with a value up to $1,500,000; or Vacant land in NSW, on which you intend to build your first home, with a value up to $800,000

The property will not be subject to an ongoing property tax once it is sold on.

How is the Property Tax calculated? (Example)

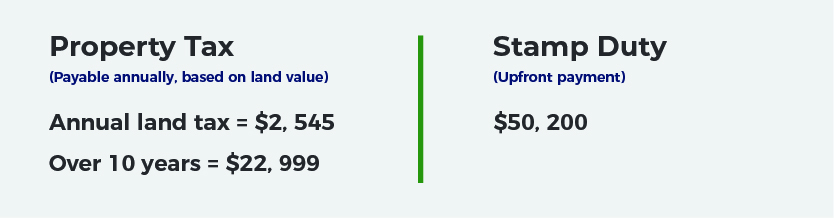

Property tax is calculated using the land value of the property. The property tax rate for the First Home Buyer Choice for the 2022–23 and 2023–24 financial years will be $400 + 0.3 per cent of the land value.

Scenario 1

Tim is looking to buy his first property in NSW, Australia with his partner and intends to buy it for owner occupied purpose. They are both Permanent Residents and looking to buy a property valued $1.3 million with land value $715k that they intend to live in for 10 years.

Therefore, it will be much more benefecial for Tim to take advantage of the FHB Choice with savings of $27, 000!

Contact us through the following channels:

- Phone: (02) 9630 3142

- Email: [email protected]