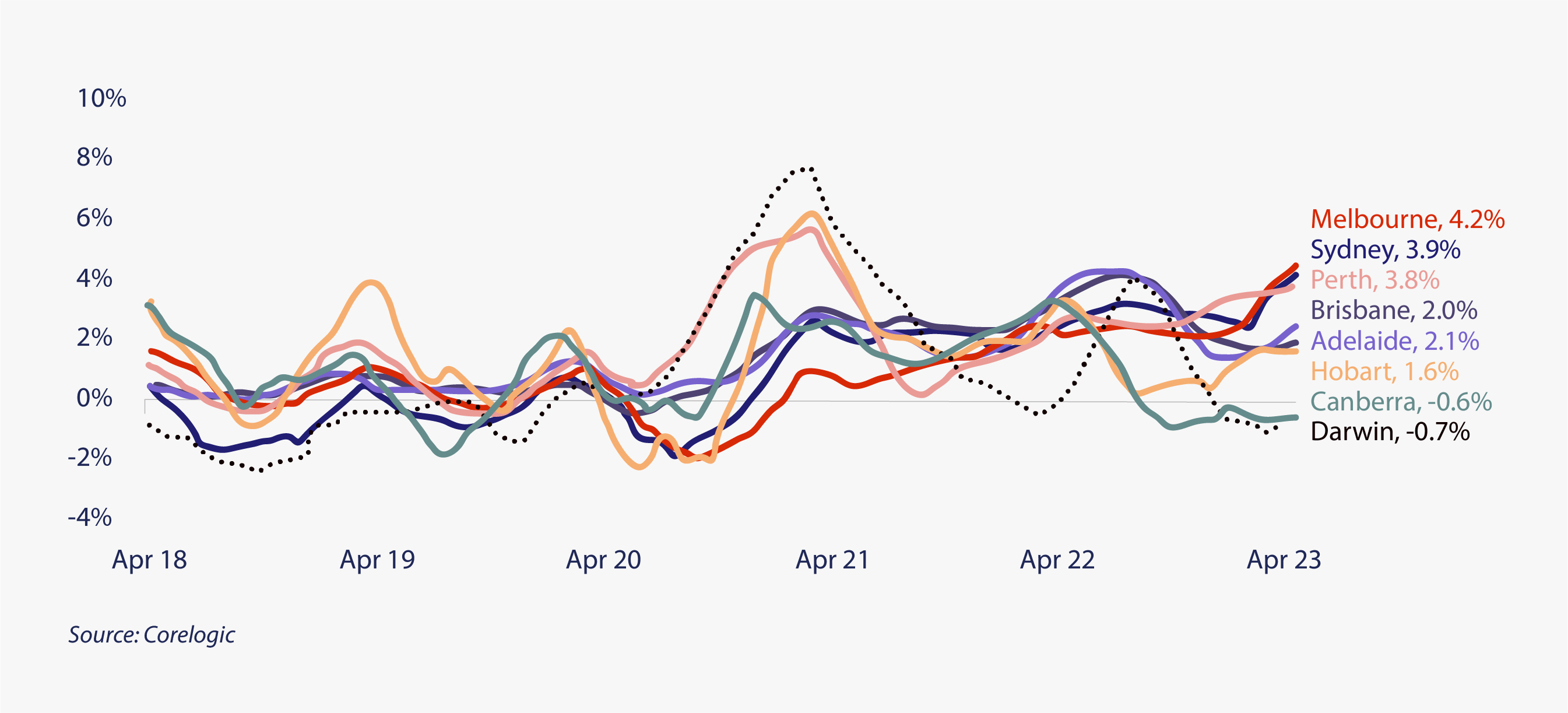

Property markets seemed to have stabilised and have started rising back again in some areas, despite RBA continuing it's rate hikes. After falling -9.1% between May 2022 and February 2023, Australian home prices rose again in April & along with other indicators suggest the home price downturn is over.

Sydney is leading the recovery in the market with a 3% growth since Jan 2023.

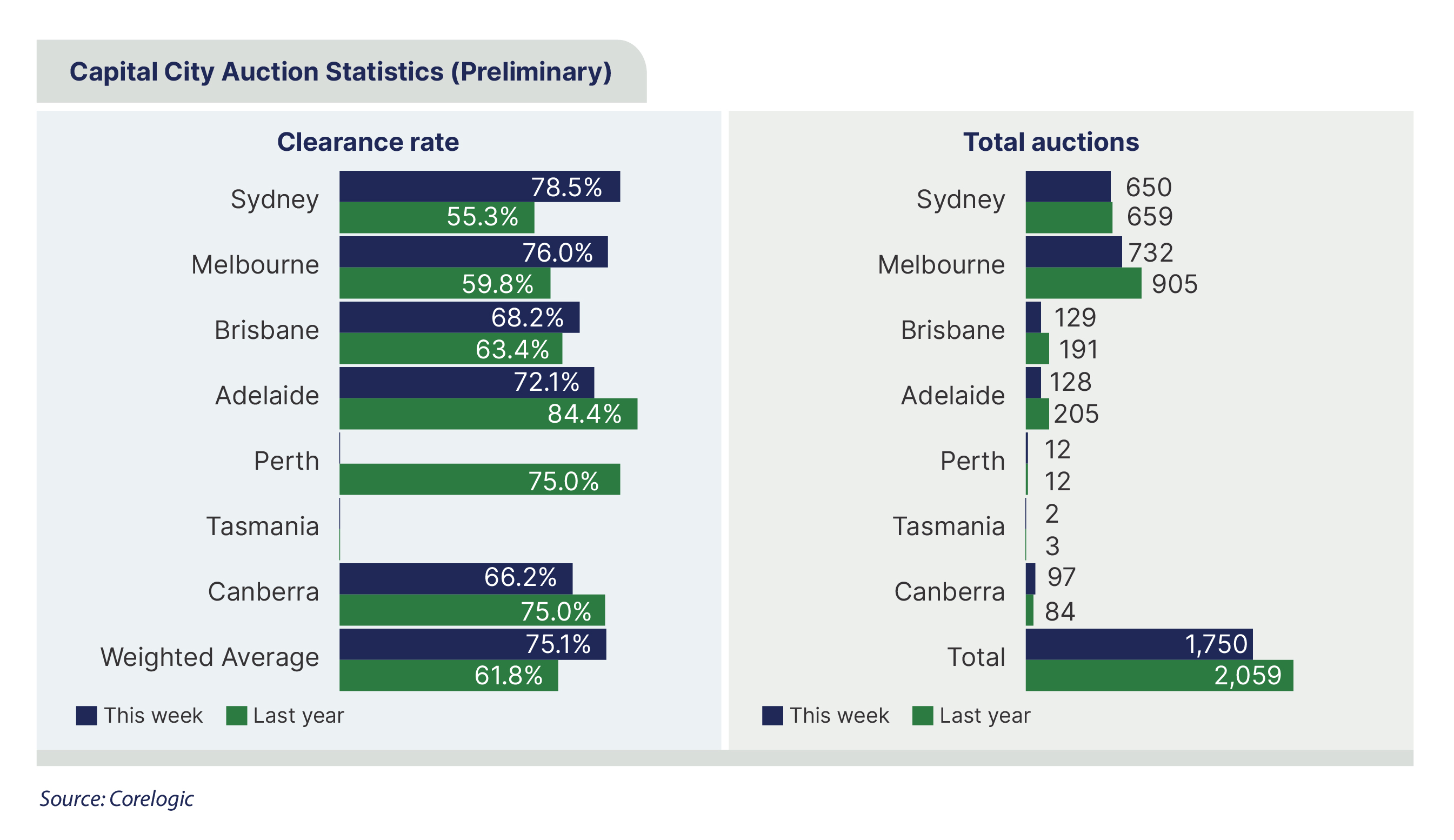

Auction markets strengthen, with low Supply and returning consumer confidence

Combined capitals record the highest preliminary clearance rate in more than a year (75.1%). Auction markets are building up a head of steam with the April holiday month now concluded with a strong performance over the remainder of the autumn selling season now clearly in prospect.

Australia’s capital cities record strongest annual rental increase in history

Growth across capital city unit rents continues to outpace house rents, increasing 1.6% and 0.9% in April, respectively. A surge in overseas migrants and international students has led to a significant shortfall in rental listings, pushing capital city rents higher. The combined capitals annual rental increase of 11.7% in the past year was a new record. Melbourne recorded the strongest rental appreciation, up 1.4%, followed by Sydney, Perth and Adelaide.

Property prices looking to stabilise and rebound over the next year

Australian home prices have continued their recovery in April with many indicators suggest that housing downturn is over and with most banks expecting growth of around 5% next year. The below go into these factors:

• Demand/supply imbalance remains where immigration is expected to be 400,000 this financial year creating a demand for an extra 200,000 dwellings.

• Supply has slowed with labour shortages, cost increase and falling building approvals.

• The increasing tight rental market with record low vacancy rates is likely to also drive house prices up.

• Investors particularly foreign are returning to market, seeking higher rental returns.

• With the expectation that RBA cash rate is at or close to its peak, consumers are gaining confidence in their property purchase decisions.

Contact us through the following channels:

- Phone: (02) 9630 3142

- Email: [email protected]