Key Points

- In August, Australia saw a sharp increase in annual inflation to 6.8%.

- The Reserve Bank of Australia (RBA) has increased rates for six consecutive months, and with the most recent increase in the first week of October, the base rate reached 2.6%, the highest level since 2013.

- The RBA said that the Australian dollar had further declined against the US currency, but had increased marginally over 2022 on a trade-weighted basis.

- Due to the already announced increase in house loan interest rates, housing mortgage payments had increased and were expected to increase higher in the future.

Whether you have caught up with the news for a while now or haven’t been able to keep yourself updated lately, you might have already felt the impact of the recent economic movements. Prices of basic commodities have started to increase, interest rates are high, and you might be thinking “what’s happening to the economy?” Well, we’ve got you covered – allow us to provide you a recap on inflation, cash rate, Australian dollar and the property market.

Record-high inflation

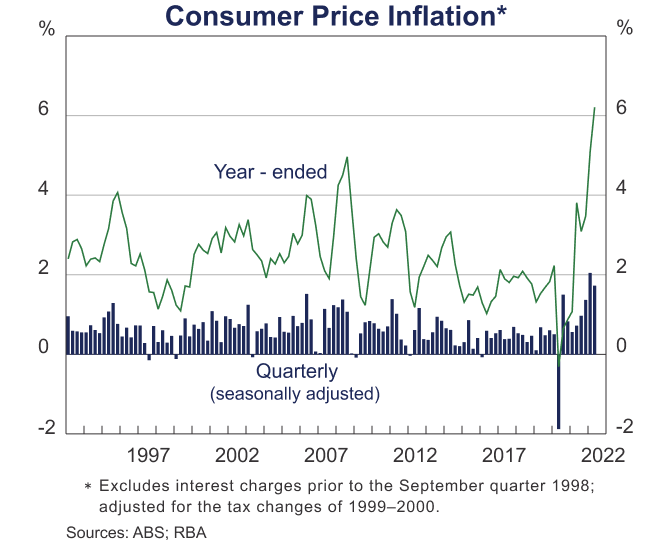

Like many other nations, Australia is struggling with a record-high cost of living. In August we saw a sharp increase in annual inflation to 6.8% from just around 2% prior to the COVID-19 pandemic. At around 1.3% back then, food inflation was also lower.

One of the fastest-rising rates among consumer items is for food. According to the most recent data from the Australian Bureau of Statistics, fruit and vegetable prices increased 18.6% over a year. Prices across the food and non-alcoholic beverages group rose to 9.3% in the past year. Meanwhile according to Finder, a comparison platform for personal finance, gas prices have increased by almost 30% since 2019.

Finder's Consumer Sentiment Tracker for September also found that the expenses causing Australians the most concern are rent and mortgage repayments, groceries, gasoline, and electricity.

The Australian government warned in July that inflation will continue to rise until it reaches a peak of 7.75% at the end of the year. A survey by the Economic Society of Australia and The Conversation in July also suggests that Australians can withstand these growing costs and deal with inflation of up to 8%.

However, many experts claim that Australia can withstand up to, or slightly above, the 2% to 3% target band set by the Reserve Bank of Australia.

Cash Rates

Australia has responded to intense inflationary pressures with an aggressive monetary reaction, much like other countries have done. The Reserve Bank of Australia (RBA) has increased rates for six consecutive months, and with the most recent increase in the first week of October, the base rate reached 2.6%, the highest level since 2013. However, the October increase is smaller than expected, a move that the RBA described as “finely balanced”.

According to the RBA’s minutes from the Oct. 4 meeting, the members carefully considered two options for the recent rate hike: maintaining the 50 basis point increases from the previous four sessions or announcing a 25 basis point increase. The inflationary environment and risks to inflation expectations were used as justifications for continuing with a 50 basis point rise. However, the board members of the central bank said they understood the merits of a smaller increase.

In the board members' notes, it was mentioned that there was a need to evaluate the effects of the large increases in interest rates to date and the shifting economic outlook before speeding up rate rises. The cash rate had climbed significantly in a short period of time, and the full impact of that increase had still to come, the minutes stated. As a result, a lesser increase than that agreed upon at previous meetings was needed.

The focus of the general public on the central bank's fight against inflation was also mentioned as a key concern. The board continues to be determined to do what is necessary to bring inflation back to its target, according to the minutes, adding that drawing out policy adjustments would help to keep public attention focused on the Board's resolve to return inflation to target for a longer period of time. The Reserve Bank of Australia has set a 2%–3% inflation target.

Australian Dollar

The Federal Reserve's decision to raise interest rates may aggravate the depreciation of the Australian dollar, but economists say that the Reserve Bank won't be overly concerned about the underperformance of the currency, even if it drops below US60¢.

Since the beginning of the year, the US dollar has gained value against the majority of other currencies, especially the British pound and the Japanese yen. In the minutes of the meeting, the RBA said that the Australian dollar had further declined against the US currency, but had increased marginally over 2022 on a trade-weighted basis. Members pointed out that bilateral rates often have less of an impact on imported inflation than the trade-weighted exchange rate.

After RBA’s October 4 meeting, the Australian dollar rose 0.14% to $0.630. The deputy governor of the central bank, Michele Bullock, said in a speech on Tuesday that the RBA can keep up with tightening by global peers.

Impact on the property market

Due to the already announced increase in interest rates, housing mortgage payments had increased and were expected to increase higher in the future. Given the increases in the cash rate before the October meeting, it was anticipated that the needed mortgage payments as a percentage of household income would rise to levels last seen in 2010, according to the RBA. This includes the cumulative effect of loans with fixed interest rates. Although still substantial, payments into offset and redraw accounts decreased slightly from 2021 to 2022. Owner-occupiers' and investors' home loan commitments had decreased, illustrating the impact of rising interest rates on home loans.

In a speech on the 19th of September, Jonathan Kearns, the RBA’s head of domestic markets, said “because higher interest rates reduce borrowing capacity and increase loan repayments, they typically result in a decline in new housing borrowing.” He explained that there is no doubt that interest rates play a significant role in determining housing finance. The timing and strength of the relationship between interest rates and housing borrowing can vary depending on a number of factors, including the fact that the factors that drive interest rates, like income growth, can also directly affect housing demand.

Plan your next financial move with us

The current financial market is tough, but it should not hinder you to reach your goals. Whether you’re planning to buy a home, start a business or upgrade your car or equipment, we can help. Let's talk about your financial goals and the solutions suitable for you.

Please get in touch with us directly. Our knowledgeable advisors and trusted brokers will work with you to determine your objectives and screen and help select a provider that meets your needs.

Contact us through the following channels:

- Phone: (02) 9630 3142

- Email: [email protected]