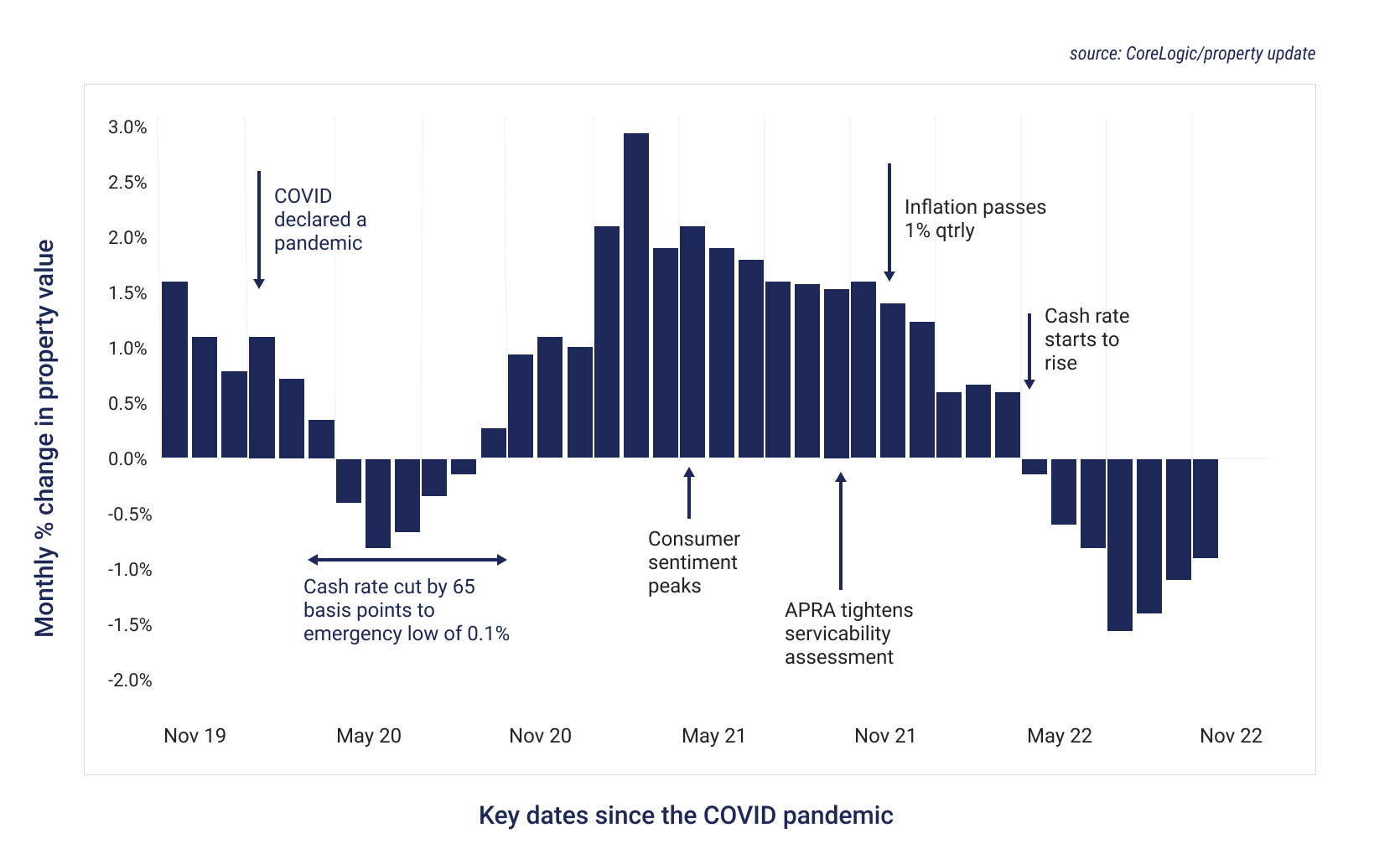

2022 was a year of two halves as prices fell from the record highs reached earlier in the year

Sydney’s property prices have steadily declined over the past year, after enjoying a strong period of growth as the Reserve Bank hikes borrowing costs to get control of inflation.

Overall Australian capital dwelling prices decreased -1.1% over the last month and are -6.1% lower over the last 12 months.

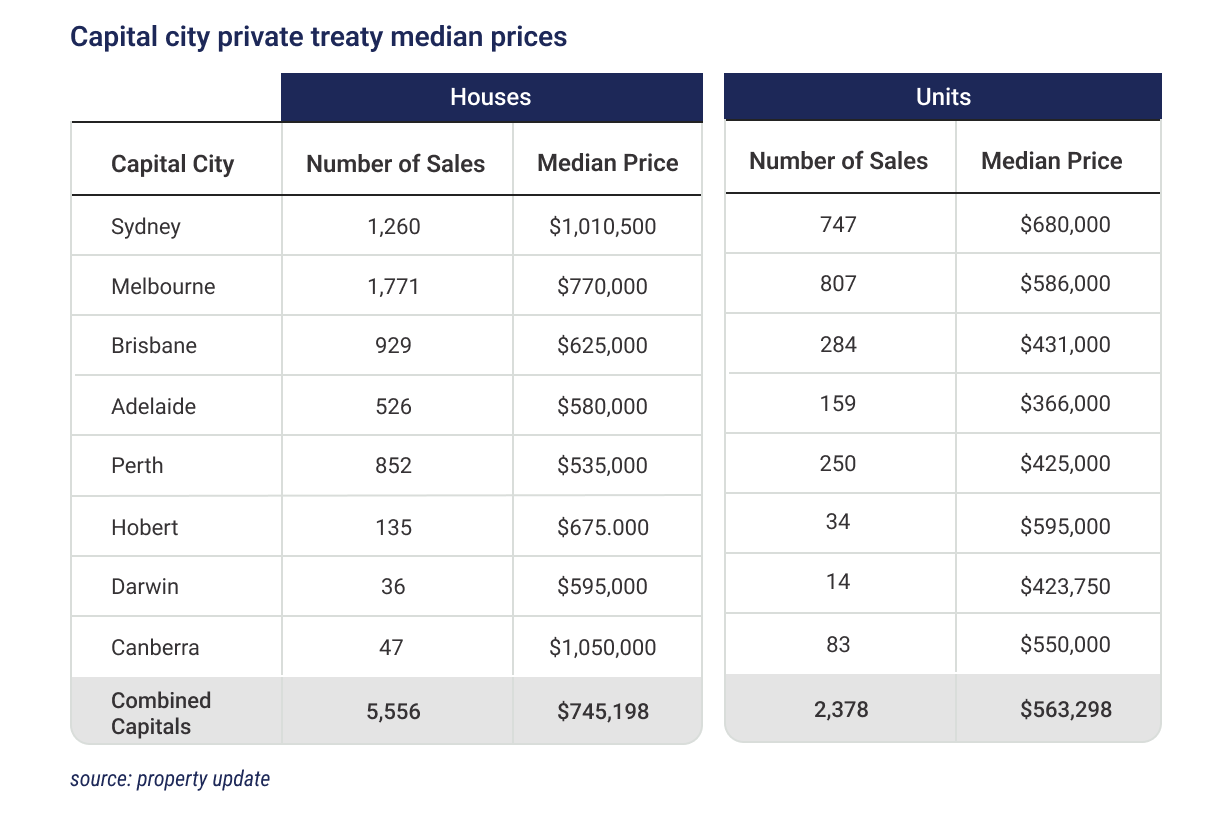

Australia’s house prices reached record highs during the peak of the Covid-19, with our most expensive city – Sydney – leading the pack.

Below graph shows the monthly change in property values since beginning of the COVID pandemic.

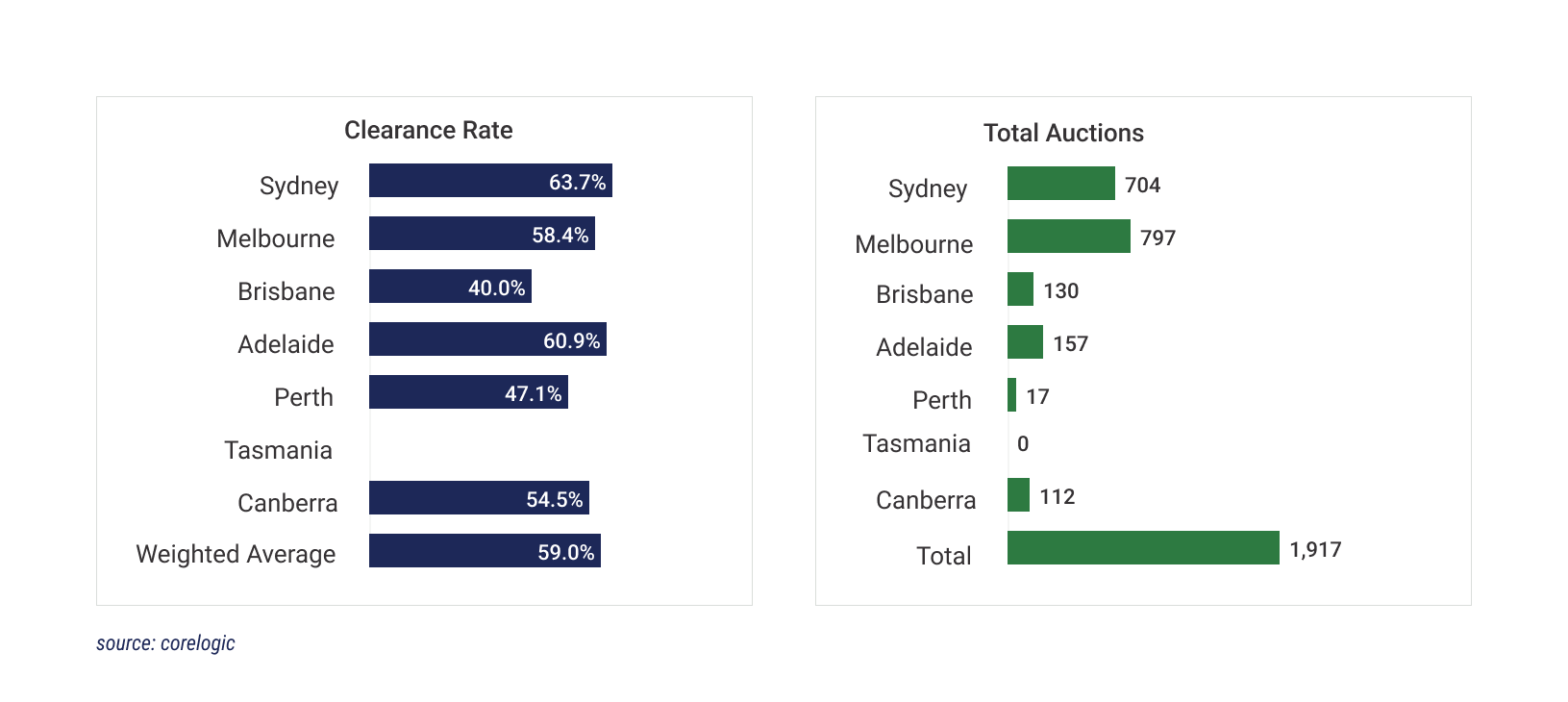

Auction Clearances, Sydney recorded the highest clearance rate since early April (63.8%)

The seventh time Sydney’s auction activity is scheduled to exceed 800 since Easter. This week’s auction volumes are 23.7% above the number recorded last week (704) but are -30.8% below the number of auctions held this time last year (1,259).

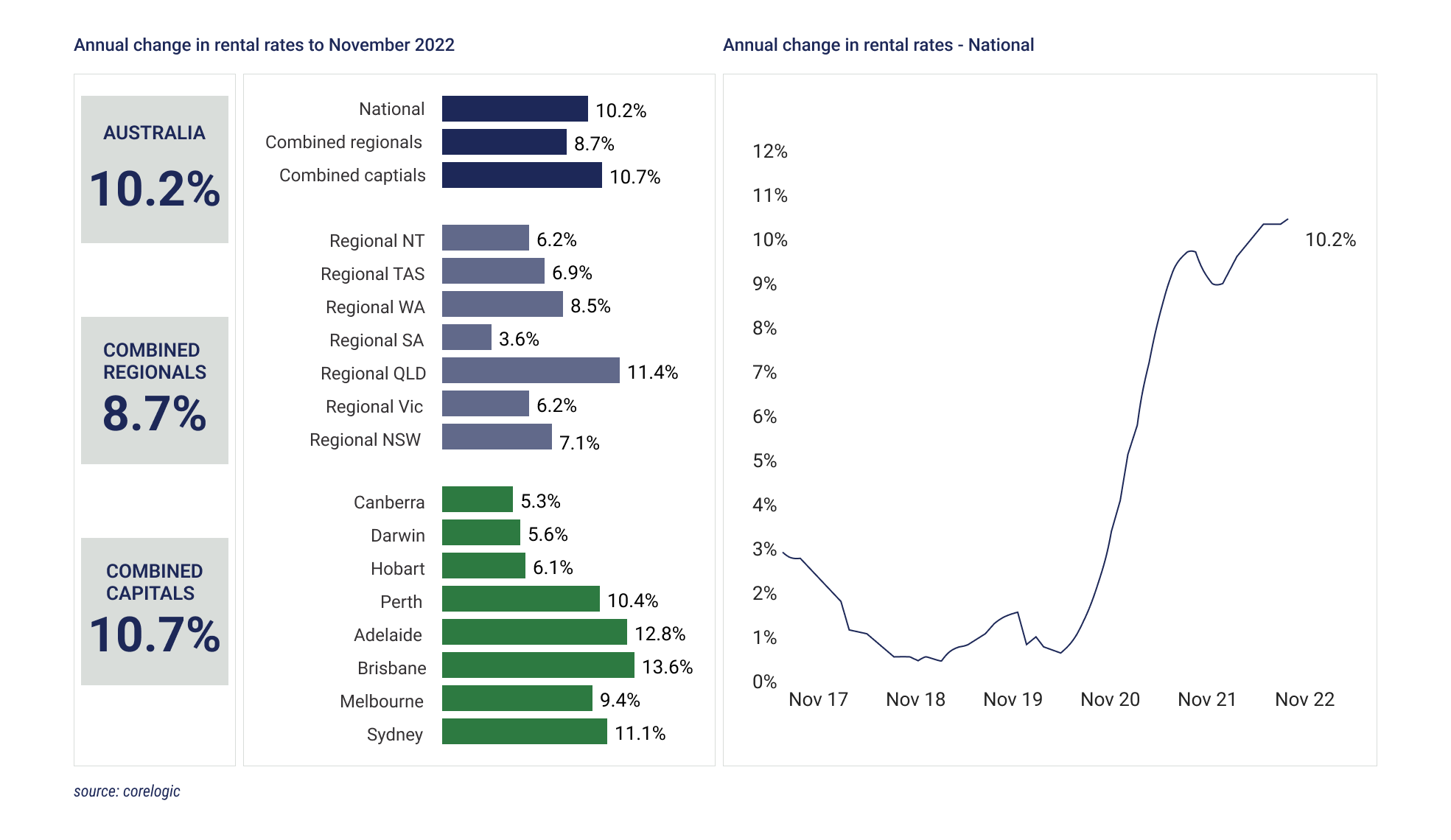

Rental market continues to tighten to record levels

The past quarter has been tough for Australian tenants, with rents rising to new record highs. Annual growth in rent values has re-accelerated.

growth in Australian rent values was 10.2% in the 12 months to November, a record high. This has partially been driven by growth in unit rents across Sydney, Melbourne and Brisbane, where rents have increased around 14-15% annually.

Will house prices go up in 2023? The answer largely depends on interest rates

Australian house prices will rise in 2023 if the Reserve Bank pauses rate rises and inflation drops, according to a new report from property analysis firm SQM Research. SQM Research's Housing Boom and Bust Report for 2023 forecasts capital city house prices will rise between 3 and 7 per cent.

- A new report expects property values to rise next year

- The forecasts depend on the cash rate not going above 4 per cent

- The big four banks are less optimistic when it comes to the property market's recovery

Australian real estate trends to watch out for in 2023

- Downturns tend to be shorter and less severe

- A fragmented property market creates upgrade opportunities

- Interest rates are one of the many factors to influence price

- An immigration surge will boost housing demand

- A price premium for the right neighbourhood

Source: www.abc.net.au/propertytribune

Thank you for reading!

Look out for our monthly property updates through the following channels

Contact us through the following channels:

- Website: www.fgfin.com.au

- Facebook: www.facebook.com/FGFOnline

- Phone: 0478 839 942 / 9630 3142

- Email: [email protected] / [email protected]