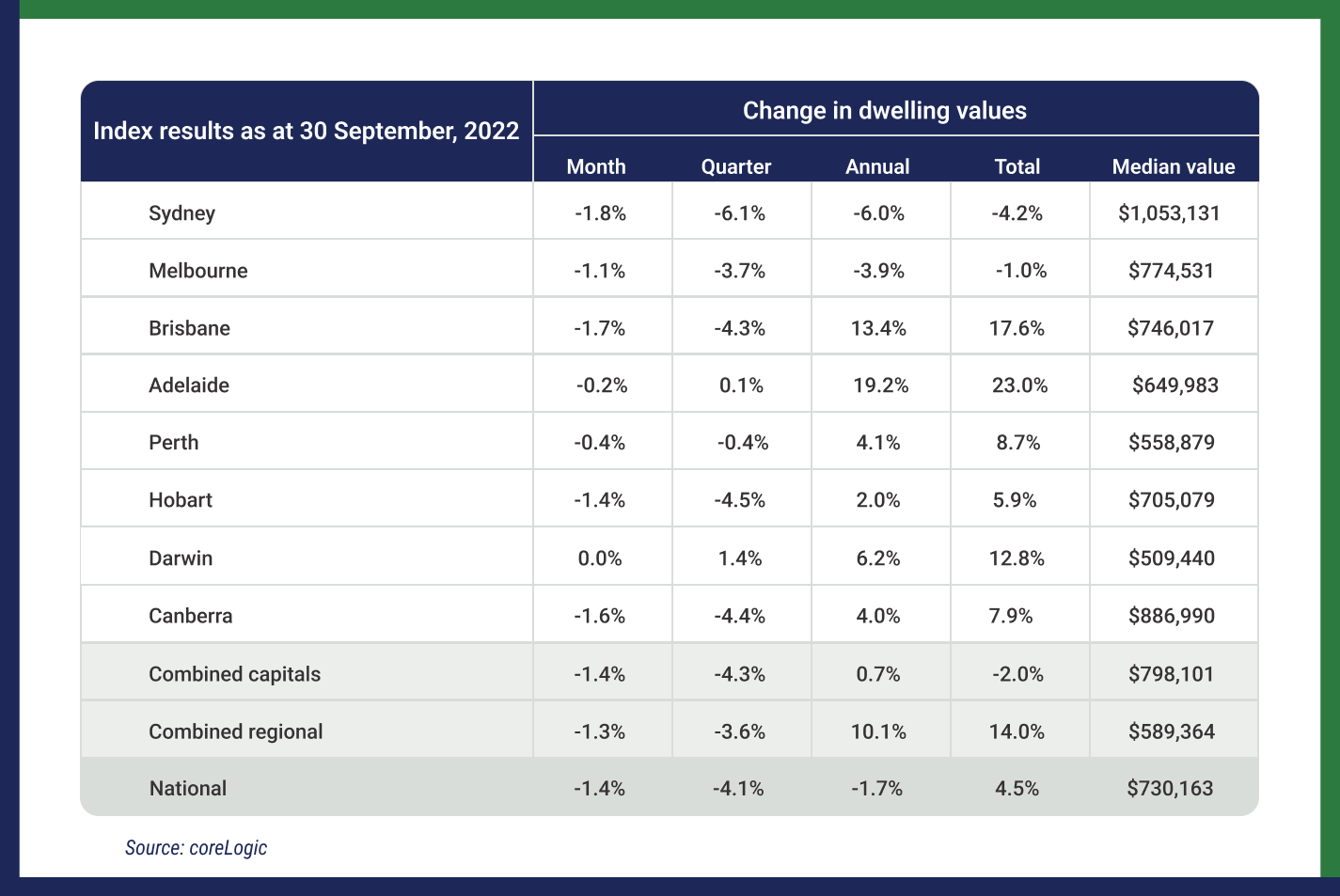

September saw a further fall in the property prices, albeit at a slower rate

There was a further fall in housing values through the first month of spring, with the national Home Value Index (HVI) recording a 1.4% decline in September.

While overall the Australian property market is in a downturn, not all the nation's property markets are being impacted equally. Each state is at its own stage of the property cycle and within each capital city there are multiple markets with property values still rising in some locations while others are stagnant or falling.

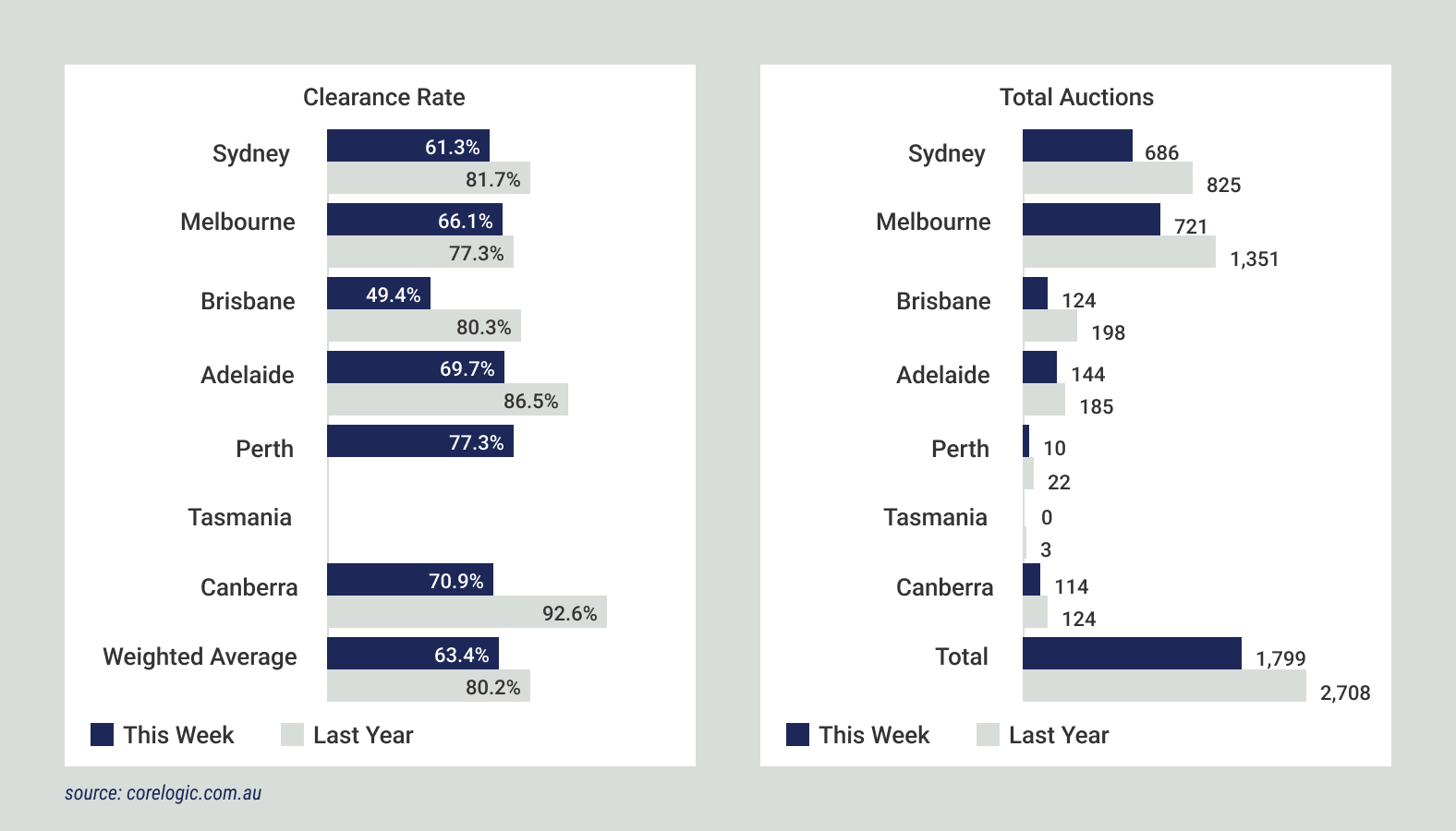

Capital City Auction Statistics

Auction activity is on the rise with 1,872 homes scheduled for auction across the combined capital cities this week, up 15.7% from last week when the Labour Day long weekend in ACT, NSW and SA, and the Queen's Birthday long weekend in Qld saw fewer homes taken to auction (1,618).

There are 752 homes set to go under the hammer across Sydney this week, rising 55.4% from last week when a combination of the Labour Day long weekend and the NRL Grand Final saw just 484 auctions held across the city. This time last year, 825 homes were auctioned across Sydney.

The figure below shows the recent clearance rates compared to last year with a general decreasing trend as well as the total number of auctions compared to last year showing an increasing trend.

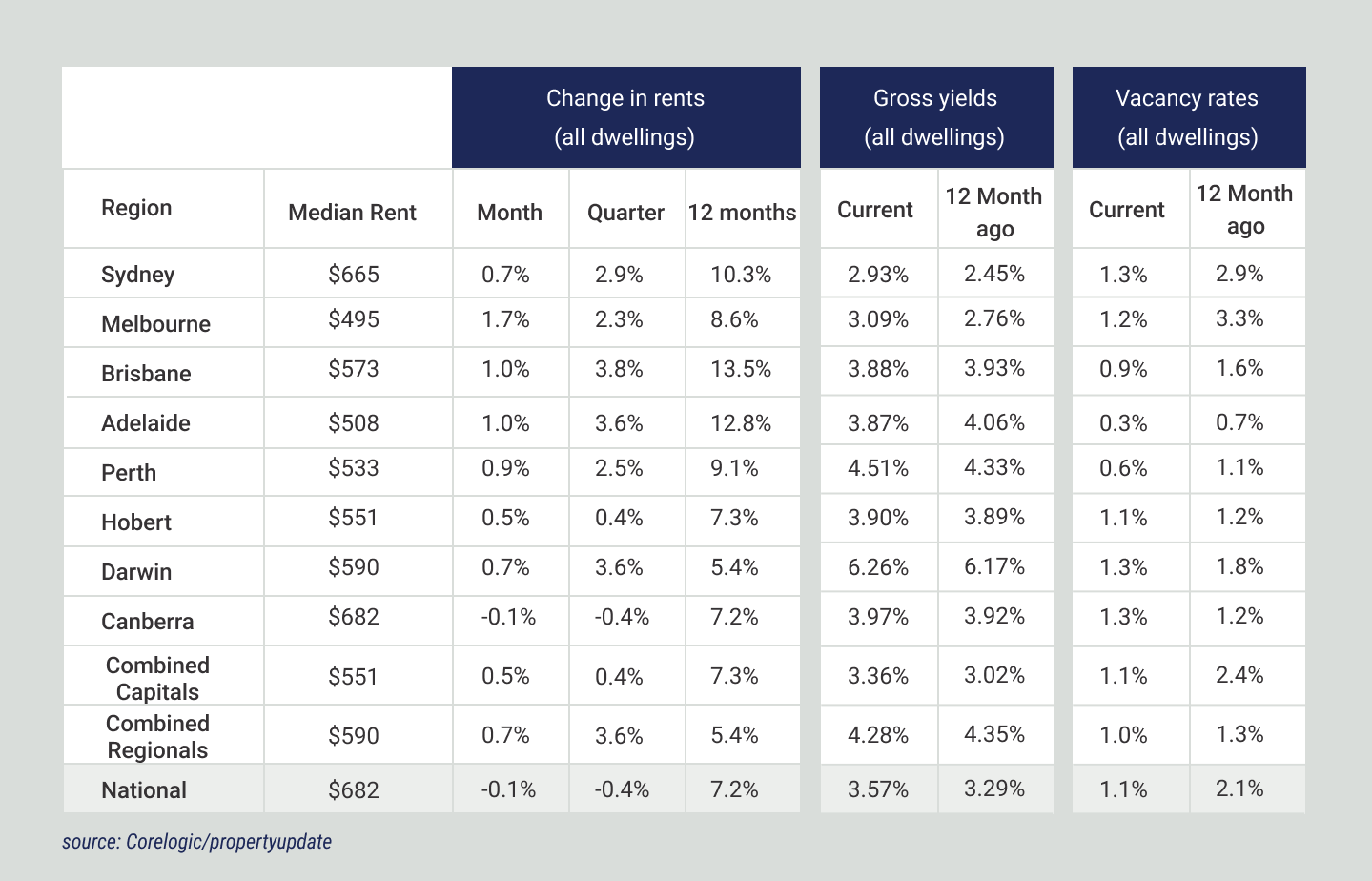

Rents rising, but at a slower rate

A gradual slowdown in rental growth in the face of such low vacancy rates could be an early sign that renters are reaching an affordability ceiling. As rents continue to rise and dwelling values generally trend lower, gross rental yields remain on a rapid upwards trajectory.

It's likely renters will be progressively seeking rental options across the medium to high-density sector, where renting is cheaper, or maximising the number of people in the tenancy in an effort to spread higher rental costs across a larger household.

The pace of rental growth has started to ease in recent months, with the national dwelling rental index rising 2.3% over the September quarter.

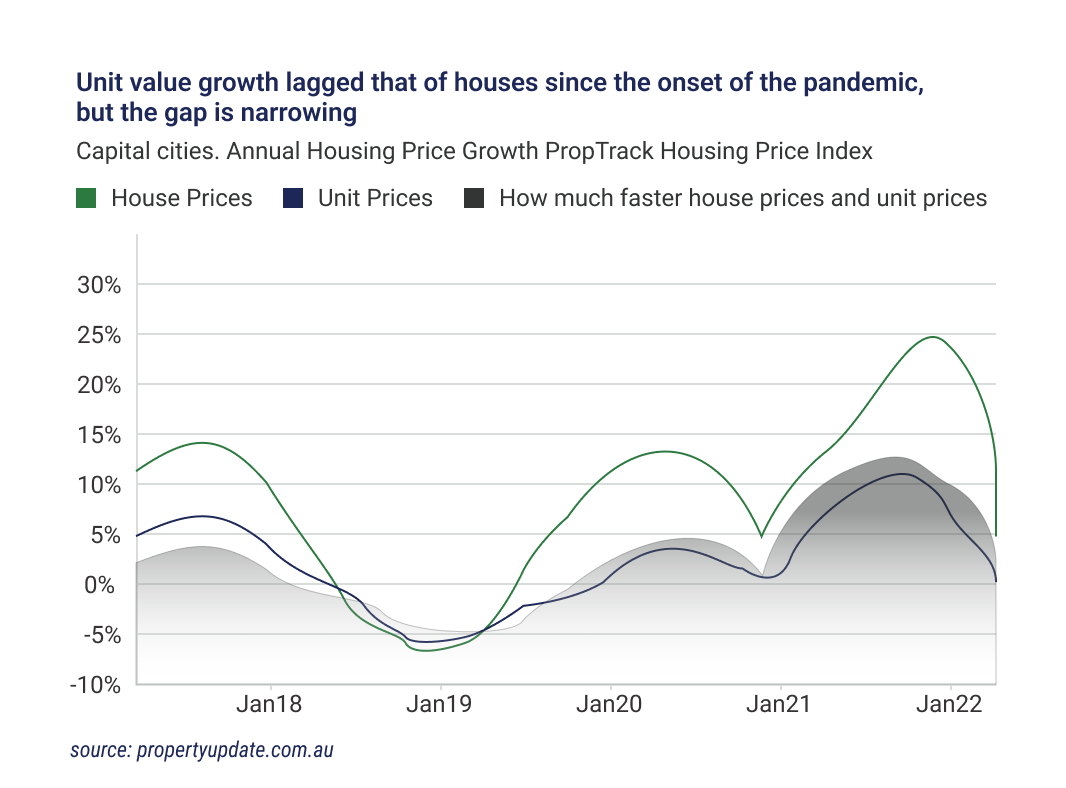

Recent news: Apartments are holding up much better than houses as rates rise

House prices rose sharply as people prioritised more space and a better lifestyle during the Covid pandemic, with record low-interest rates also making it cheaper to borrow more.

But as rates have climbed, home prices have quickly begun to fall around the country, down 2.7% nationally from their March peak.

Well, housing affordability will get worse as repayments become more expensive, and together with the relative discount and typically cheaper price point the apartment market offers, units are likely to continue to hold up better. According to Prop Track's Home Price Index, house prices have fallen by 3.6% nationally since March, whereas the decline in unit prices has been less severe, down 2.6% from the February peak.