Key Points

- High loan interest rates and inflation are causing the Australian housing market to be in a state where buyers are reluctant to buy a property.

- Major banks are offering deals and cashbacks for investors in order to increase home finance commitments.

- Tax deductions continue to help property investors.

- Investors are still earning gross yields of up to 7% despite declining property values and rising interest rates because of rental demand.

Like many other nations, Australia's interest rates are rising quickly as the country's central bank attempts to control inflation, which reached a record high of 6.8% in the 12 months to August.

In an effort to combat the "scourge" of inflation, the Reserve Bank of Australia has raised interest rates for seven consecutive months, bringing the official cash rate from 0.1% in April to 2.85% today. As a result, the additional borrowing costs have been passed on by banks through higher lending rates, which are currently ranging between 4% and 5% and are expected to continue to grow.

Due to high loan interest rates and some buyers deciding to wait until prices drop even further, the Australian housing market is currently in a state where buyers are reluctant to buy a property. If you’re one of those who are unsure about adding a property now to their investment portfolio, you’re not alone.

“Should I buy an investment property now?” is one of the most common questions among investors today, and we’re here to shed some light on that. Here are some things to consider when investing on a property in today’s market.

Discounts for investors from major lenders

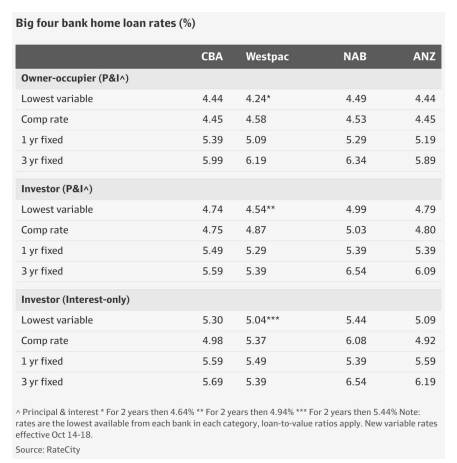

According to government analysis, lenders are eager to increase investor home finance commitments, which have significantly declined with little sign of bottoming. As a result, they are cutting three-year fixed term loans and are providing property investors discounts of up to 250 basis points off typical variable rates. Standard variable rates at big banks are often substantially higher than those from smaller rivals.

For instance, CBA, one of the biggest lenders in the country, lowered its three-year rate for principal-and-interest investors by 100 basis points to 5.59 percent, or around 40 basis points less than the same term for owner-occupiers.

Mortgage brokers also claim that lenders are slashing their typical variable rates, which range from roughly 3.34% to close to 74%, by up to 250 basis points for investors.

Depending on loan size, around 30 lenders are also providing mortgage cashback incentives ranging from $1,500 to $10,000.

As record numbers of borrowers evaluate their next step, mortgage brokers predict that lender competition for new customers—and to retain existing ones—will increase over the coming months.

Tax deductions

The fundamental rule of taking out a loan to pay for an investment property, according to Mark Chapman, tax director at H&R Block, is that interest payments on the loan to buy the property are tax deductible. Therefore, rate increases affect investors' cash flows less than they do first-time homebuyers' and owner-occupied properties.

"The tax deductibility of interest is what makes property such an attractive investment for many," continues Chapman. "It's a vital element in 'negative gearing,' which is the ability to balance losses against other income."

When a property is sold, capital gains tax is assessed at the sellers' marginal tax rate, however if the property is kept for longer than a year, a 50% CGT rebate may be available. This essentially reduces the amount subject to tax by half and is comparable to reducing the rate of tax paid on the full gain, according to Chapman.

The cost of home upgrades, legal fees, stamp duty, appraisals, and mortgage termination and exit fees are also included in the items that can be reduced from the cost base to lower tax obligations.

High yield due to rental demand

Due to increased population growth and rental shortages, real estate investors are still earning gross yields of up to 7% despite declining property values and rising interest rates.

Due to a dramatic rise in the number of returning students and workers from abroad following the relaxation of COVID-19 restrictions, rents are growing at record rates and vacancies are at historic lows of roughly 1%.

According to Sydney leasing agencies, desperate potential renters are willing to pay above-market rentals and even to 12 months' worth of rent up front to secure a house.

Contrarian strategy

In an article by UNSW Sydney, Business School’s Professor Peter Swan said even though a downturn or recession is not ideal, it can cause a shake-up in the stock markets, which can be favourable for a contrarian investment approach. Those who are interested in investing might purchase at a discount and earn bigger returns over time. That entails taking the chance to buy when others are selling as a "contrarian approach," which frequently succeeds in the asset market. Basically, avoid doing what other people are doing. This suggests that you should purchase when everyone is reluctant to do so, and vice versa.

A word of caution

Whether you decide to buy in ultimately depends on you and your situation, just like at any other point in the cycle. Depending on where you're purchasing, how much you can finance, and other personal criteria, you'll need to decide when is the best moment for you to buy. There are many advantages to purchasing during a market slump, but those advantages can also come with risks. It is always best to do your research, keep an eye on the market, and be willing to put in some time to talk to experts.

Plan your next financial move with us

The current financial market is tough, but it should not hinder you to reach your goals. Whether you’re planning to buy a home, start a business or upgrade your car or equipment, we can help. Let's talk about your financial goals and the solutions suitable for you.

Please get in touch with us directly. Our knowledgeable advisors and trusted brokers will work with you to determine your objectives and screen and help select a provider that meets your needs.

Contact us through the following channels:

- Phone: (02) 9630 3142

- Email: [email protected]