What's ahead for the property market in 2023?

2023 looks to be the year where the property market stabilises

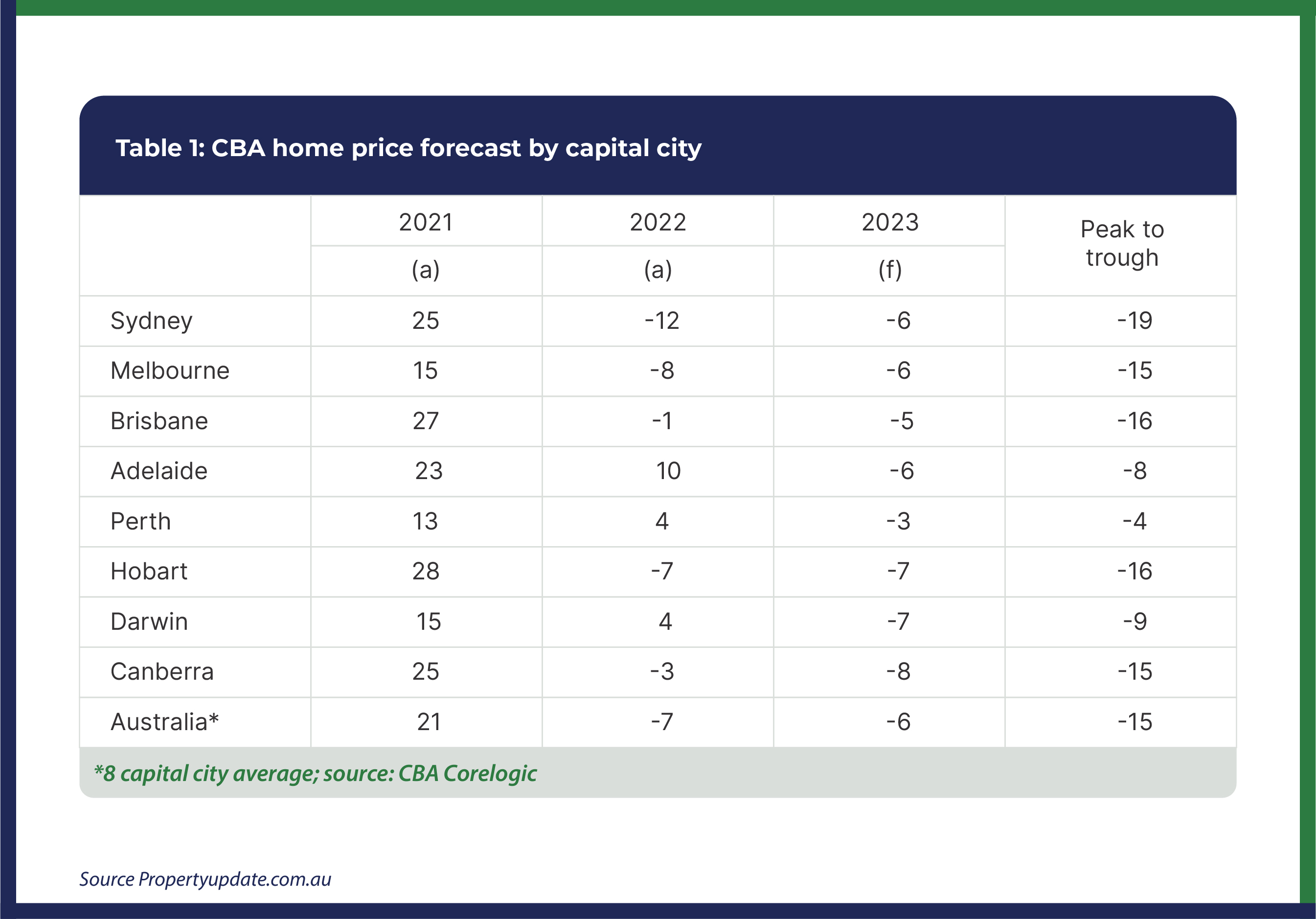

With the RBA increasing the cash rate again by 0.25% in Feb, further falls in home values are expected through the early months, followed by a stabilisation in housing prices after interest rates find a peak. However a broad-based rise in housing values would be dependent on interest rates coming down, or on other forms of stimulus. With immigration rebounding rapidly, this will further support the economy and property stablisation.

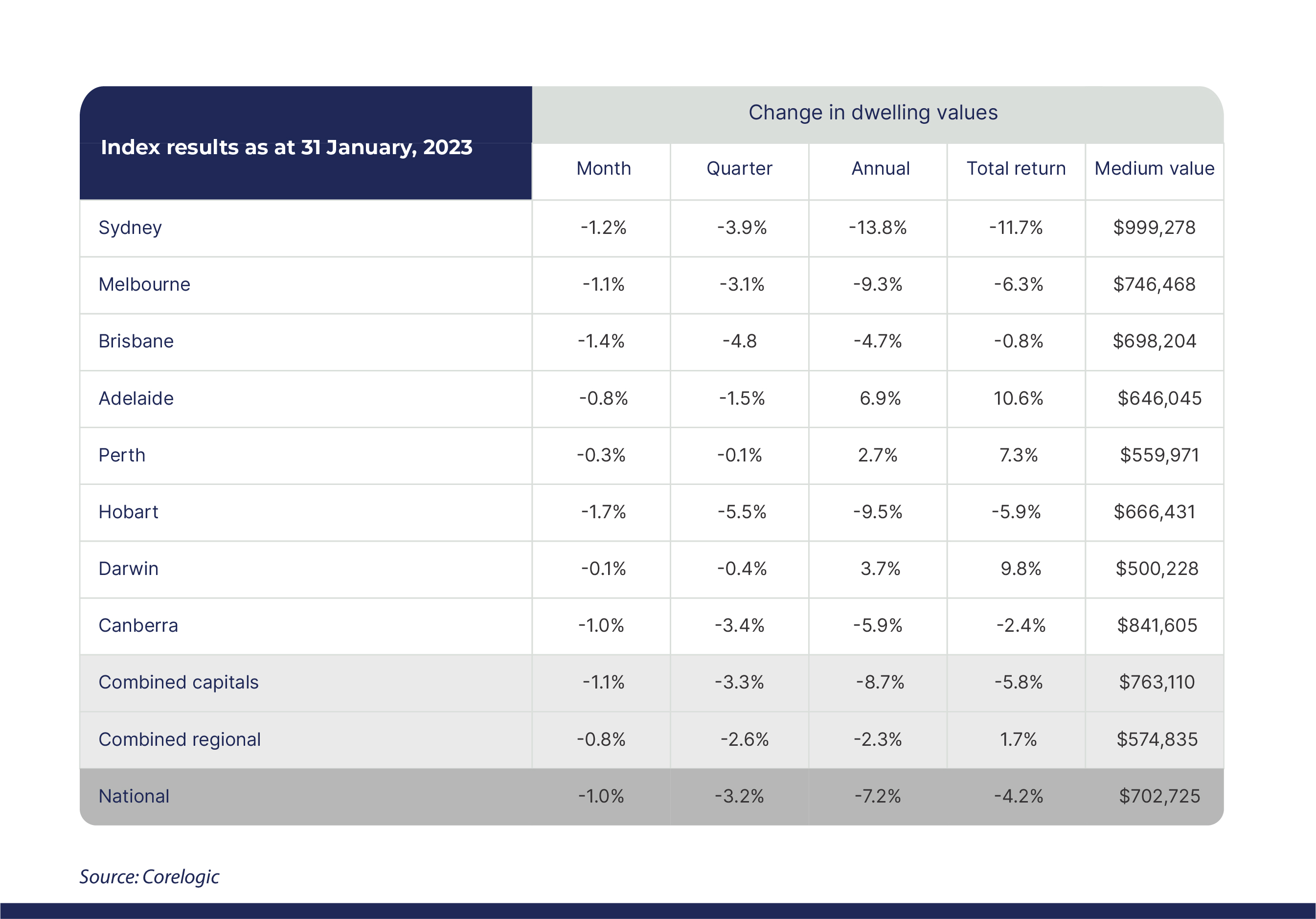

Dwelling prices continue to decline in Jan 2023

Dwelling prices fell by 1.1% across the capital cities and are down by 8.9 from their April 2022 peak. Sydney continues to lead the decline in property with a cumulatice fall of 13.8% since its Jan 2022 peak.

After peaking in May 2022 CoreLogic’s national Home Value Index fell -5.3% over the 2022 calendar year, and while overall the Australian property market is in a downturn, not all of the nation’s property markets are being impacted equally.

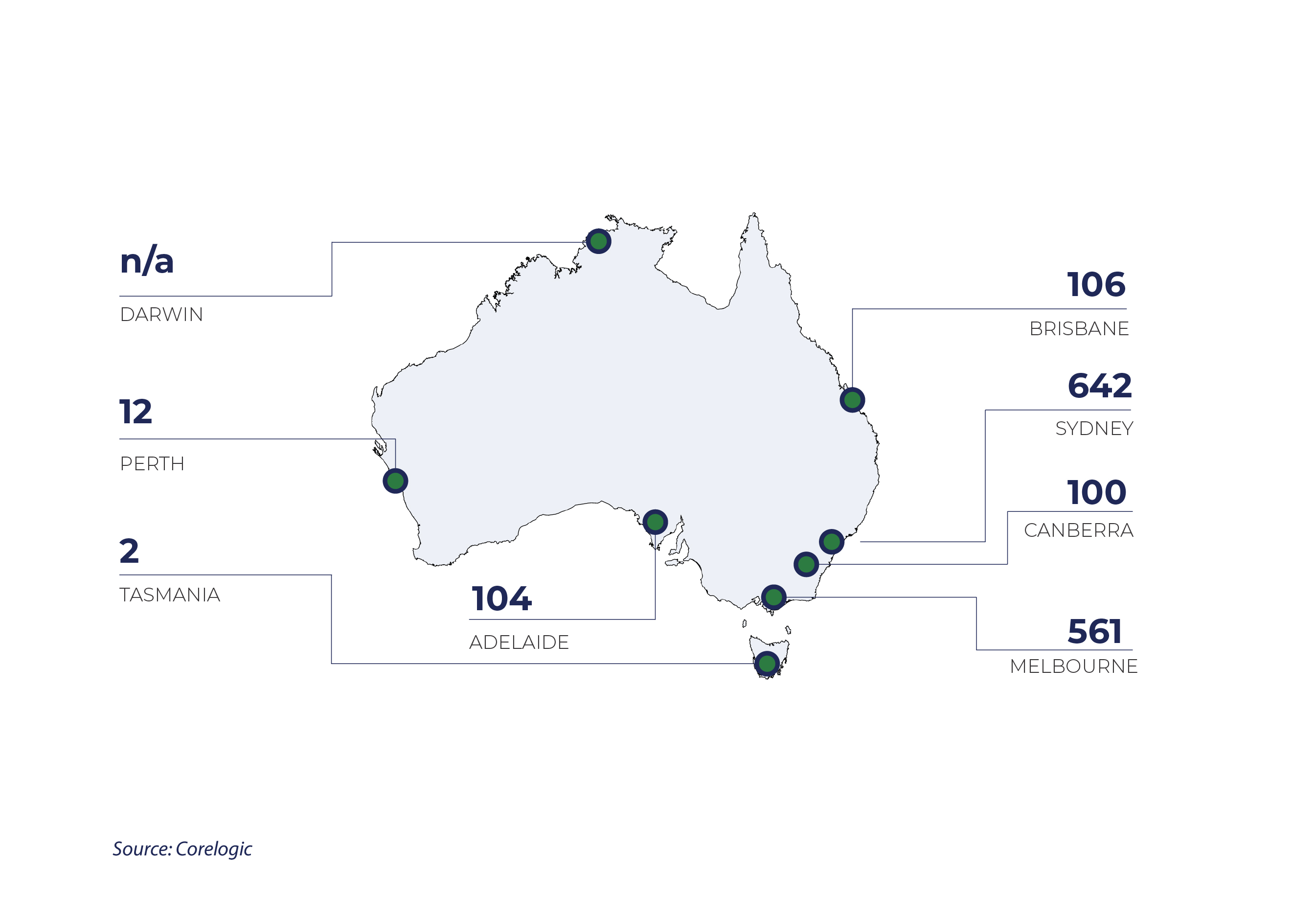

Auction markets slow down

Australia’s auction markets are off to a slightly slower start this year, with 1527 capital city homes scheduled for auction this week.

Sydney is set to be the busiest auction market this week with 642 homes scheduled for auction, up 51.4% from last week when 424 auctions were held, although down -27.5% from this time last year (886).

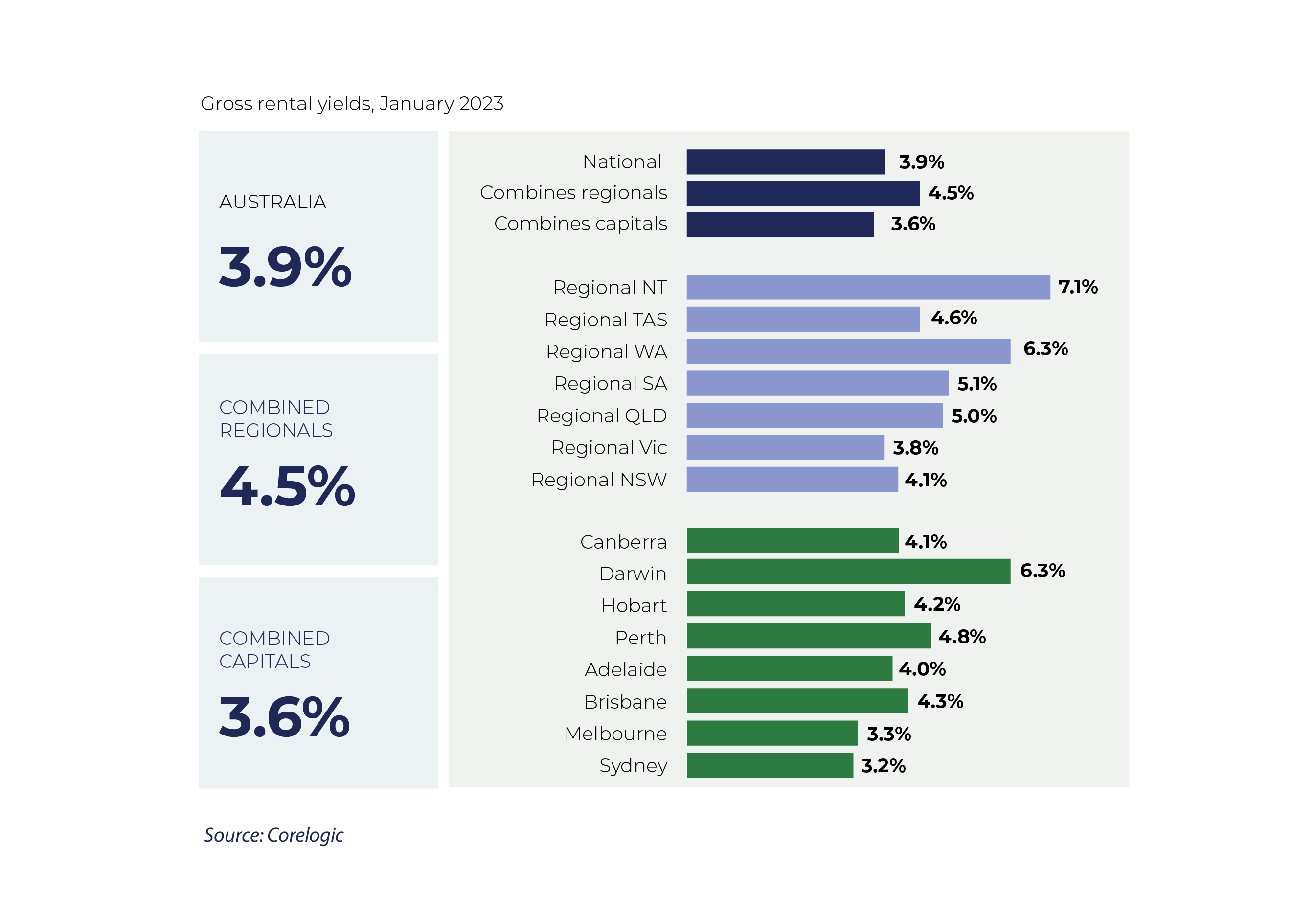

Rental Rates & Rental Yields

Annual growth in rent values eased slightly in January, to 10.1%. Annual growth in Australian rent values recently peaked over the 12 months to December, at 10.2%.

Through January 2023, Australian gross rent yields rose to 3.9%, up from a recent low of 3.21% a year earlier. This is the highest rent yield since November 2019.

Three key takeaways for 2023

While inflation will take time to reduce to historic averages in Australia, the headline rate is projected to begin falling in 2023.

Falling inflation would in turn take pressure off the RBA to keep hiking interest rates – meaning the number and pace of rate rises is set to slow.

While property prices are expected to fall further this year, the market is expected to stabilise towards the second half of 2023.